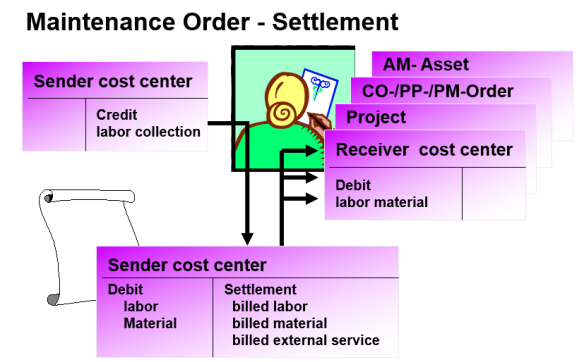

- The resources used in carrying out maintenance work are debited to the maintenance order as material costs, labor hours, external services etc.

- These costs are temporarily collected in the maintenance order and then transferred to the receiver specified in the settlement rule of the maintenance order. This process is called settlement.

- The receiver of these costs is an Accounting object, for example the cost center of the functional location, the asset to which the equipment belongs or the order combining several maintenance orders together.

- The following requirements must be met for the settlement of a maintenance order:

a. The maintenance order must have been released.

b. The maintenance order must have been given the status “settlement rule created”.

c. The maintenance order should have accumulated costs that have not yet been settled.

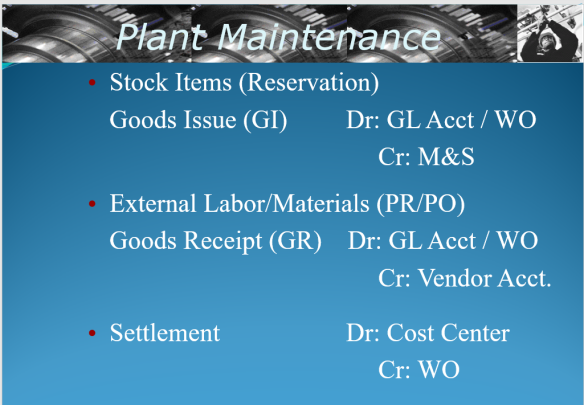

For other accounting entries, for stock items done through reservation, Goods Issue, this will be debited through GL account or Work Order & credit to M&S or RMS ( repairs and maintenance ) depending on what kind of activity it is.

For Services and purchase on Non-Stock Items, done upon Goods Receipt and debited through GL account or Work Order and credited through Vendor Acoount.

Come Settlement time, all the activities will be debited through the Work Order and Credited through the Cost Center.